As the year draws to a close, one cannot help but look towards what’s next for the EU Emissions Trading Scheme (EU ETS). Earlier this autumn, not only did EU Parliamentarians vote in favour of a 60% emission reduction target for 2030, but many EU member states have also backed a 55% target.

It remains to be seen what the final EU target will be – first the EU council must form its position (expected in December) – but nevertheless, a 55%-60% target is a big step up from what was expected earlier in the year.

The surprise of the 60% vote in Parliament was evident, with the market rallying significantly in the days after. However, not quite ready to set a new high above €31, the market soon drifted off yet again, and intensified as second waves of Covid-19 started spreading through Europe.

Are European Union Allowances (EUAs) always doomed to be the disappointing commodity? Policy-driven markets can be prone to this, and certainly, EUAs do have a history of lacklustre moves. But I would argue that this is about to change. To see what’s going on, we must first take a step back and look at what’s happening in climate policy on a global scale.

The changing face of corporate emissions

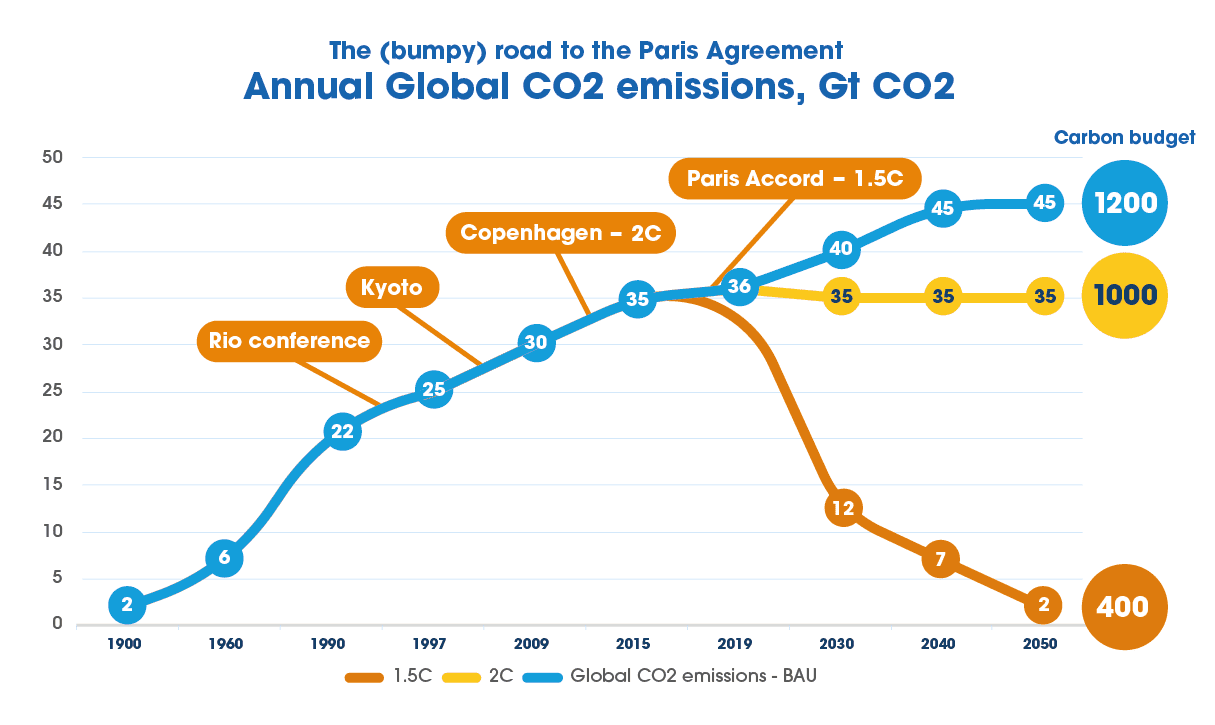

Climate scientists have quantified the rough carbon budget we have left to emit by 2050 to stay within certain expected temperature increases. The Paris target of pursuing efforts to limit the temperature increase to 1.5 °C effectively translates into a remaining budget of 400bn tonnes of CO2.

With our current level of global emissions of around 35bn tonnes, we will reach that in just 12 years. The consequences of not reducing emissions sufficiently is a very sobering thought – one which has thankfully led to a swath of net-zero pledges from both countries and corporates.

Countries like the UK have already enshrined a net-zero target in law, while other notable announcements in recent weeks have come from South Korea, Japan and China. And even where countries may lag behind in climate policy, like the US, corporates have been far from shy in announcing targets.

As a result, several standards, such as the Science Based Targets Initiative, are seeing a record number of corporates sign up to their emission reduction pledges. Of course, there is still a long way to go in implementing successful policies, but the trend is clear: consumers, investors and policymakers are embracing net-zero emission targets like never before.

In effect, there are fewer and fewer places for polluters to hide, which is good of course – as the world heads for its hottest ever recorded year. But as policies tighten around the world, what really is required are price signals in order for greener investment decisions to be made.

Many technology options for reducing emissions already exist of course. Especially in Europe, the huge rollout of renewable energy has seen a significant cut in emissions from the power sector, but industrial solutions are lagging far behind.

Hydrogen and carbon capture and storage have been lauded as the next big thing, but rolling these technologies out on-scale will take years, if not decades. Some trailblazing corporates and funds are not waiting for markets, and have instead set ambitious internal carbon prices of up to $200/t CO2 – thus driving investment into still-exotic technologies such as direct air carbon capture, but we need this kind of signal to be more widespread.

With the increased level of policy ambition, will EU lawmakers finally deliver the tightness required in the EU ETS? Doing some basic modelling will provide the required insight – a 55% or 60% emission reduction target will bring with it a cap of below 1bn tonnes CO2 in 2030 – some 600mt less than the verified emissions in 2019.

This is a huge shift for a system which has seen emissions drop by only around 300mt in the last eight years, with the bulk of that coming from the power sector.

What does the future hold for emissions targets?

At first, the magnitude of what needs to take place over the next few decades may seem unimaginable. But what market players and EU ETS installations are now faced with is not just the start of Phase IV – which begins on January 1st – but also the steeper 2030 targets currently being negotiated.

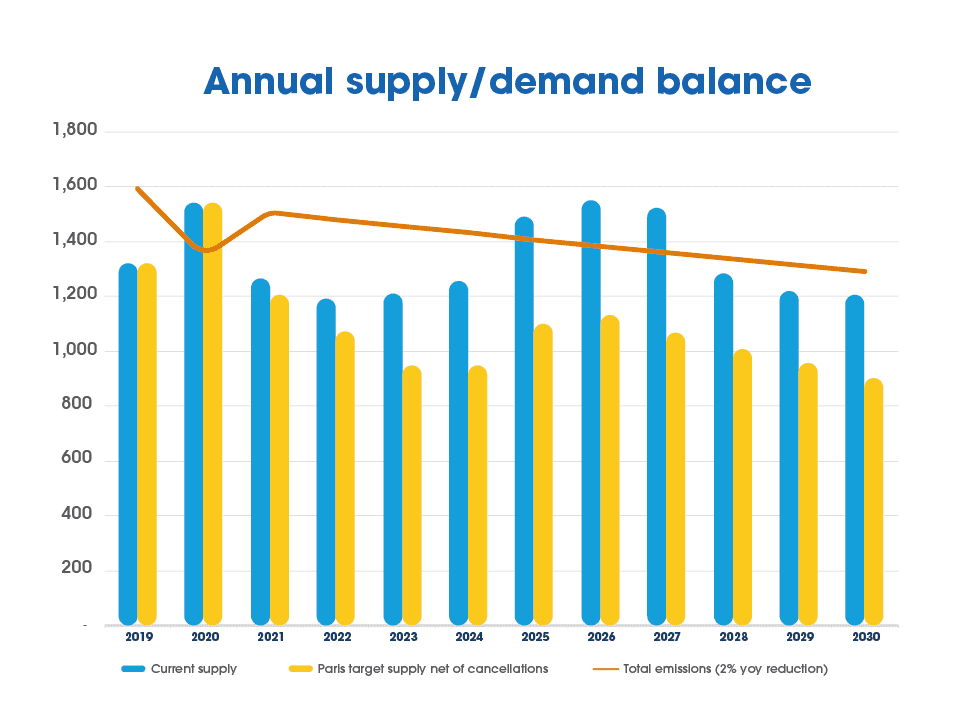

Even without those future targets, the average annual supply to the EU ETS will only be around 1.25bn t EUAs over the next four years – courtesy of the existing Market Stability Reserve. Assuming emissions recover from their Covid-dip in 2020 (when emissions are expected to come in at around 1.3-1.4bn t CO2), starting from January, the system will run a deficit of roughly 1bn EUAs over the next four years.

Utilities and industrials that have been used to sitting with a surplus of EUAs in their registries will need to think again, because the total number of EUAs in circulation will drop to below 500mt – not even enough to cover 50% of currently-assumed utility hedges. On top of that, when a 55% or 60% target by 2030 is implemented, the annual linear reduction factor – by which the cap drops every year – will need to increase from its current 2.2% to one closer to 6%.

And if that isn’t enough to convince you of the EU ETS’s tightness, the Market Stability Reserve is also due to be reviewed in 2021. Here, policymakers have already mentioned options such as a further one-off cut in the cap to bring it down to current emissions and a prolonging of the current 24% intake rate.

The EU has always been at the forefront of global climate policy, and with COP26 due to take place in the UK next year, they are surely determined to stick to their reputation. Only time will tell how the markets will react, but policymakers have shown their cards now, and in the current day and age, would you bet against tighter targets being implemented?

So, here’s to an exciting next decade. The climate clock is ticking, and Phase IV is just days away.

Click here for the latest news and features from SEFE Marketing & Trading, or visit our Trading careers page to find out about our latest opportunities in Environmental Markets.

The views, opinions and positions expressed within this article are those of our third-party content providers alone and do not represent those of SEFE Marketing & Trading. The accuracy, completeness and validity of any statements made within this article are not guaranteed. SEFE Marketing & Trading accepts no liability for any errors, omissions or representations.