A part of the SEFE Marketing & Trading team since November 2014, Ed was previously our Global Strategy & Business Development Analyst, and Gas, Power and Derivatives Advisor before taking on his current role in January 2017. Since then, Ed has been involved with the development of our long-term power trading strategy, optimising our assets and signing both renewable power purchase and thermal energy management agreements.

With a breadth of credentials and energy knowledge to his name, Ed lends us his know-how here, discussing this important development and the effects it is likely to have through the rest of the year. Here is what Ed had to say:

2018 – A defining year in UK storage deployment

Last year, the roll-out of over 150MW of batteries forged steps towards a new commercial model for electrical storage. Given the size of the roll-out vs the market’s requirement, developers must now adapt their business models. Energy storage systems have previously offered flexibility to the grid through frequency response services and now must complement this with storage of energy for higher price periods and additional ancillary services.

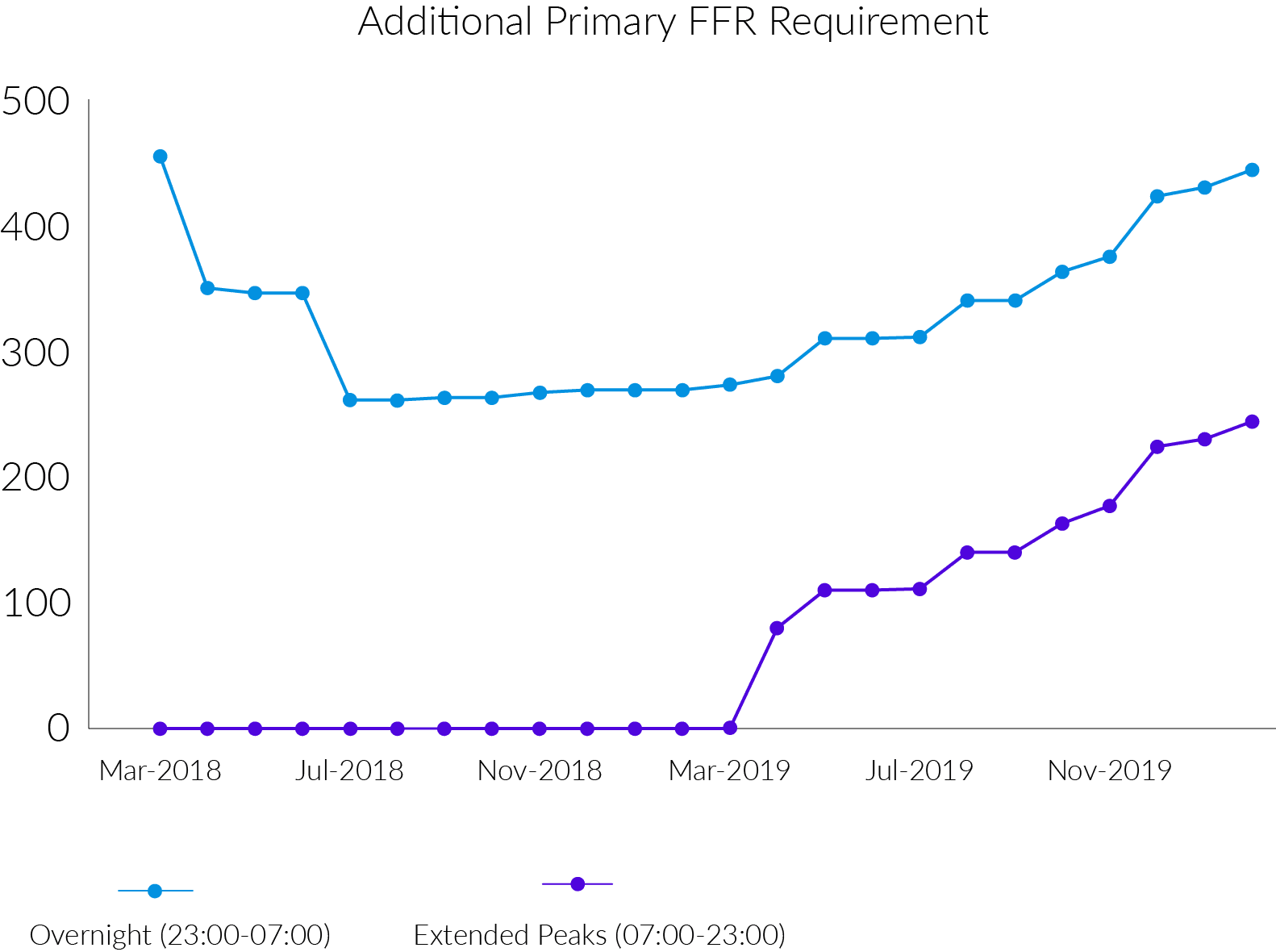

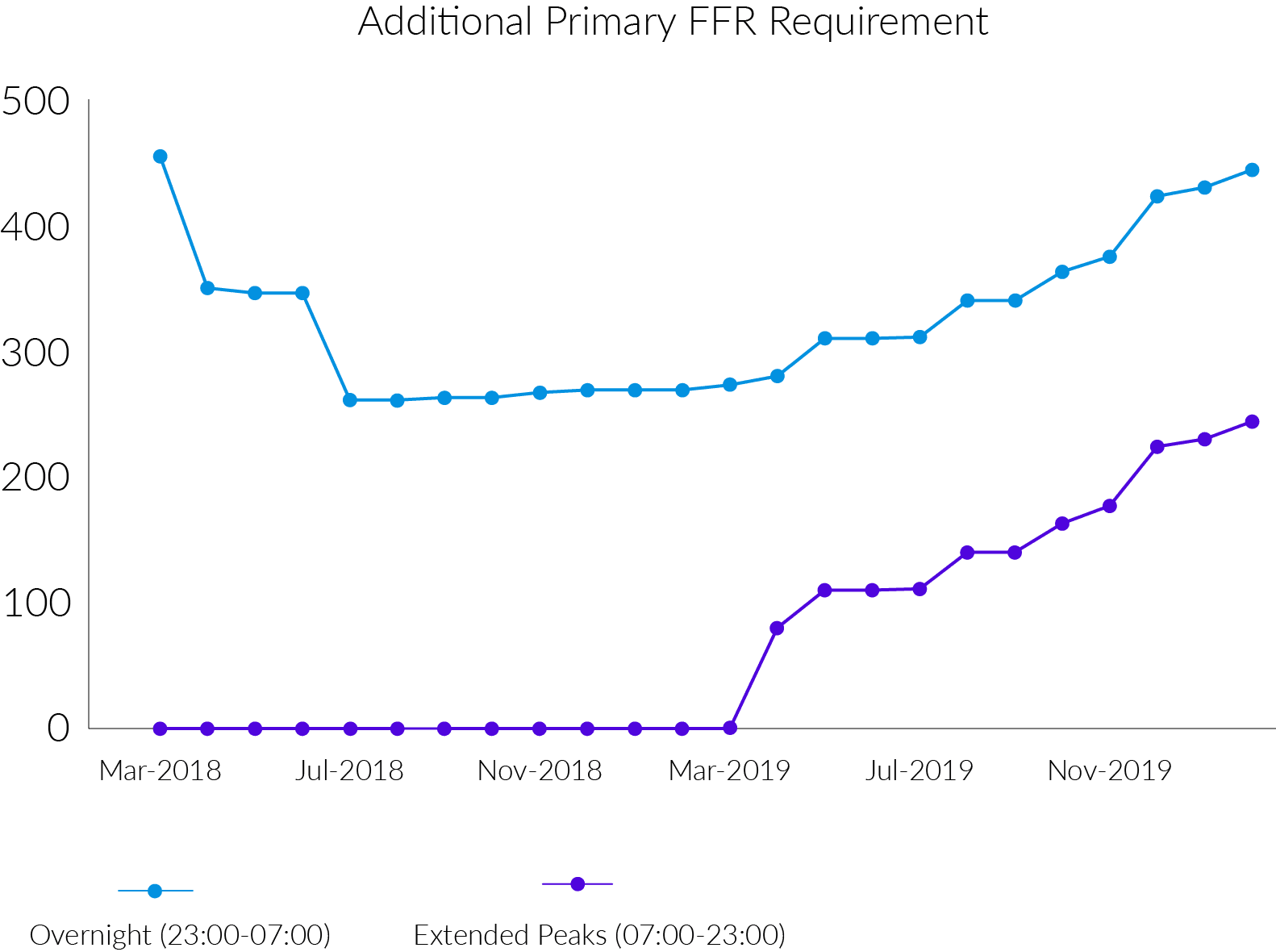

These response services previously consisted of a one-off auction for Enhanced Frequency Response, or EFR, providing active power within one second in response to changes in system frequency. Firm Frequency Response, or FFR, is a monthly auction procuring a range of response types with the aim of controlling grid frequency. While both provided stable revenue, the change in market requirements means that new sites are no longer able to adopt the 24/7 frequency response model alone.

Source: National Grid, March 2018 Tender

FFR requirements have been fulfilled from a variety of sources, leaving a market that no longer requires additional FFR during extended peaks. So, while the change to an extended peak/overnight structure from the 24/7 model is a drawback in terms of stable revenue, it also creates the opportunity to access different revenues.

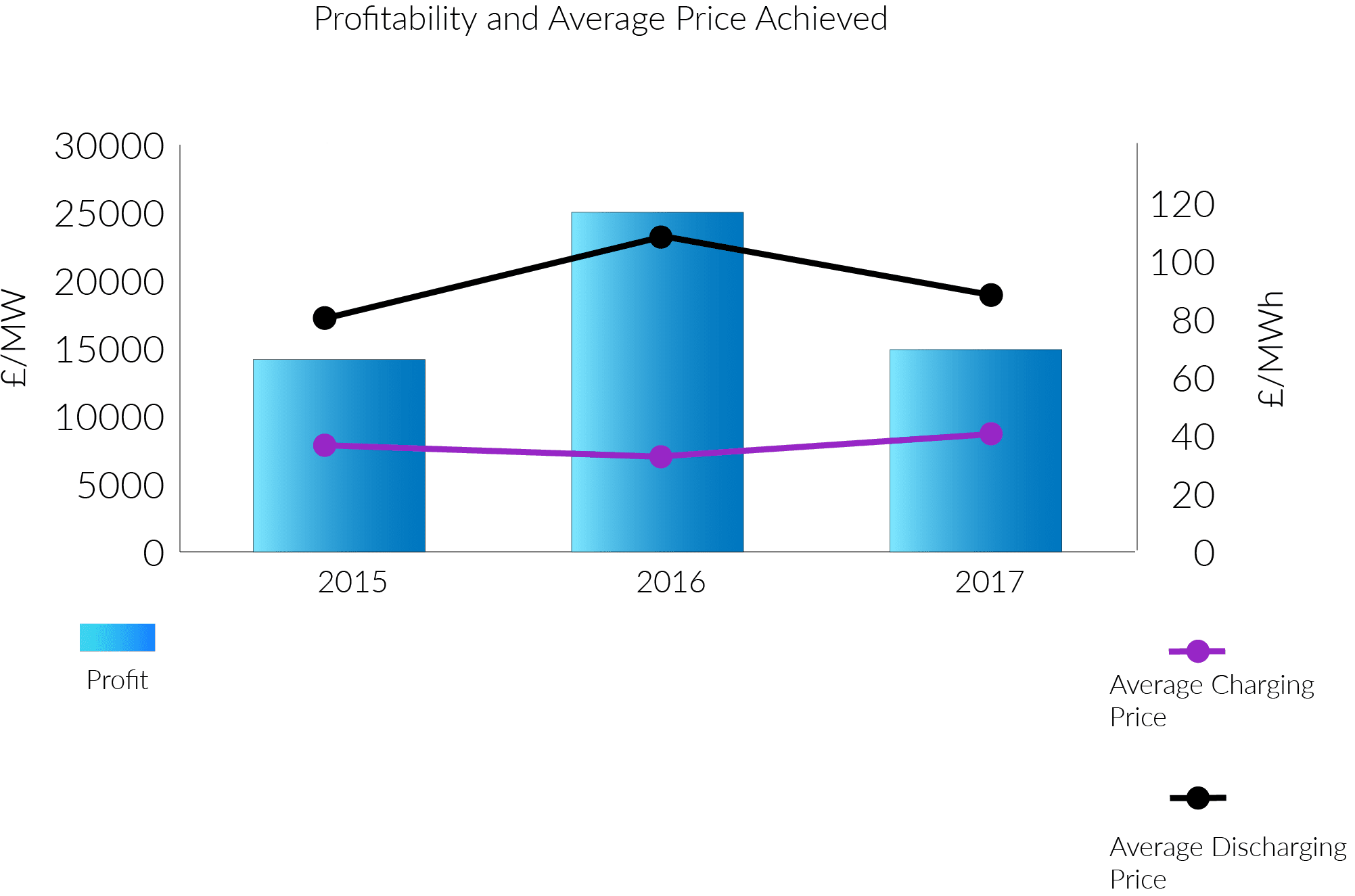

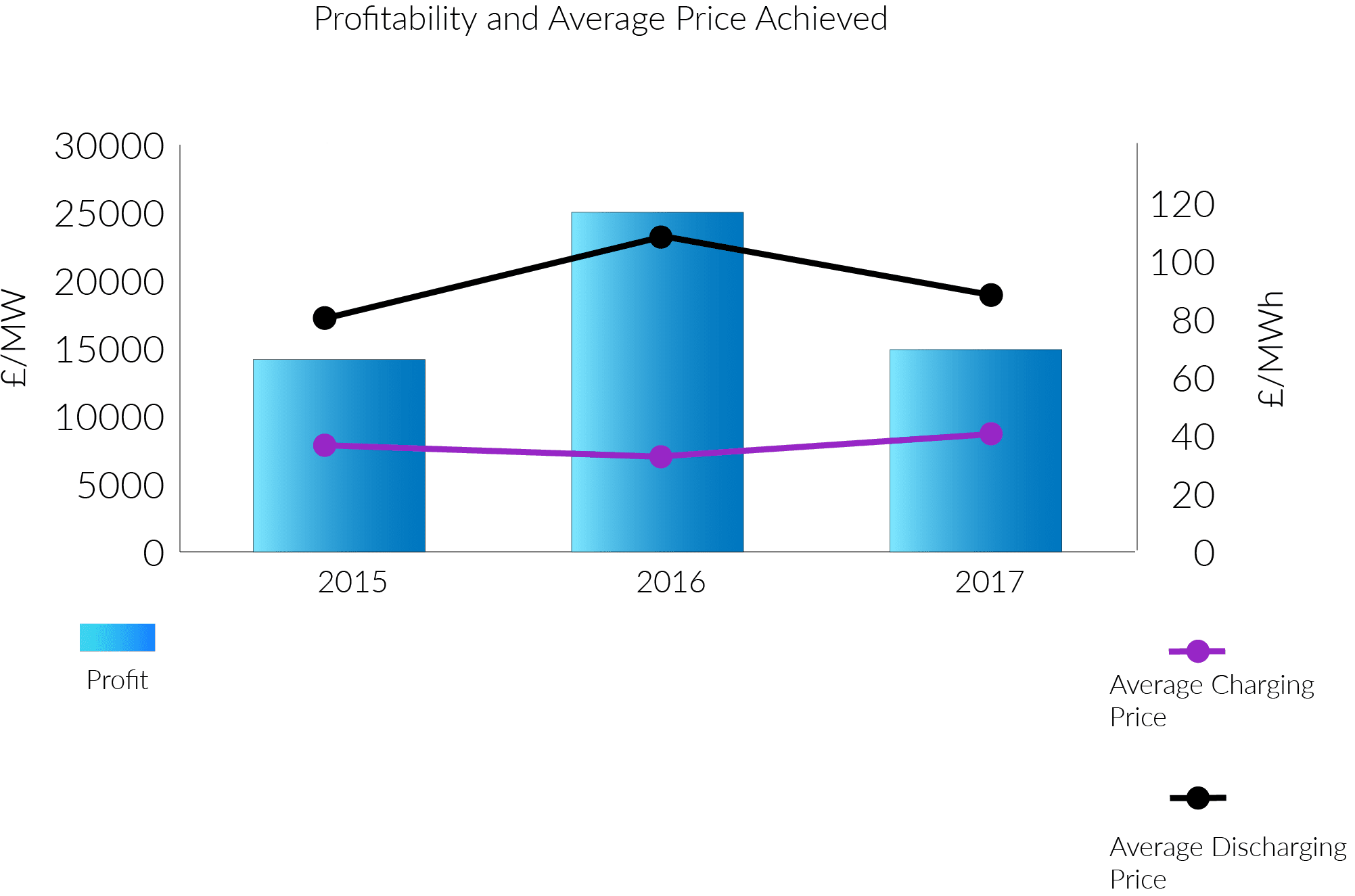

Through the use of short-term market traders, appropriate market access and quantitative support e.g. forecasting of imbalance pricing, it is possible to complement the constrained frequency revenues with wholesale optimisation benefits. Further benefits abound from location, Distribution of System charges, residual TRIAD charges and behind-the-meter opportunities.

Source: SEFE Marketing & Trading Analysis

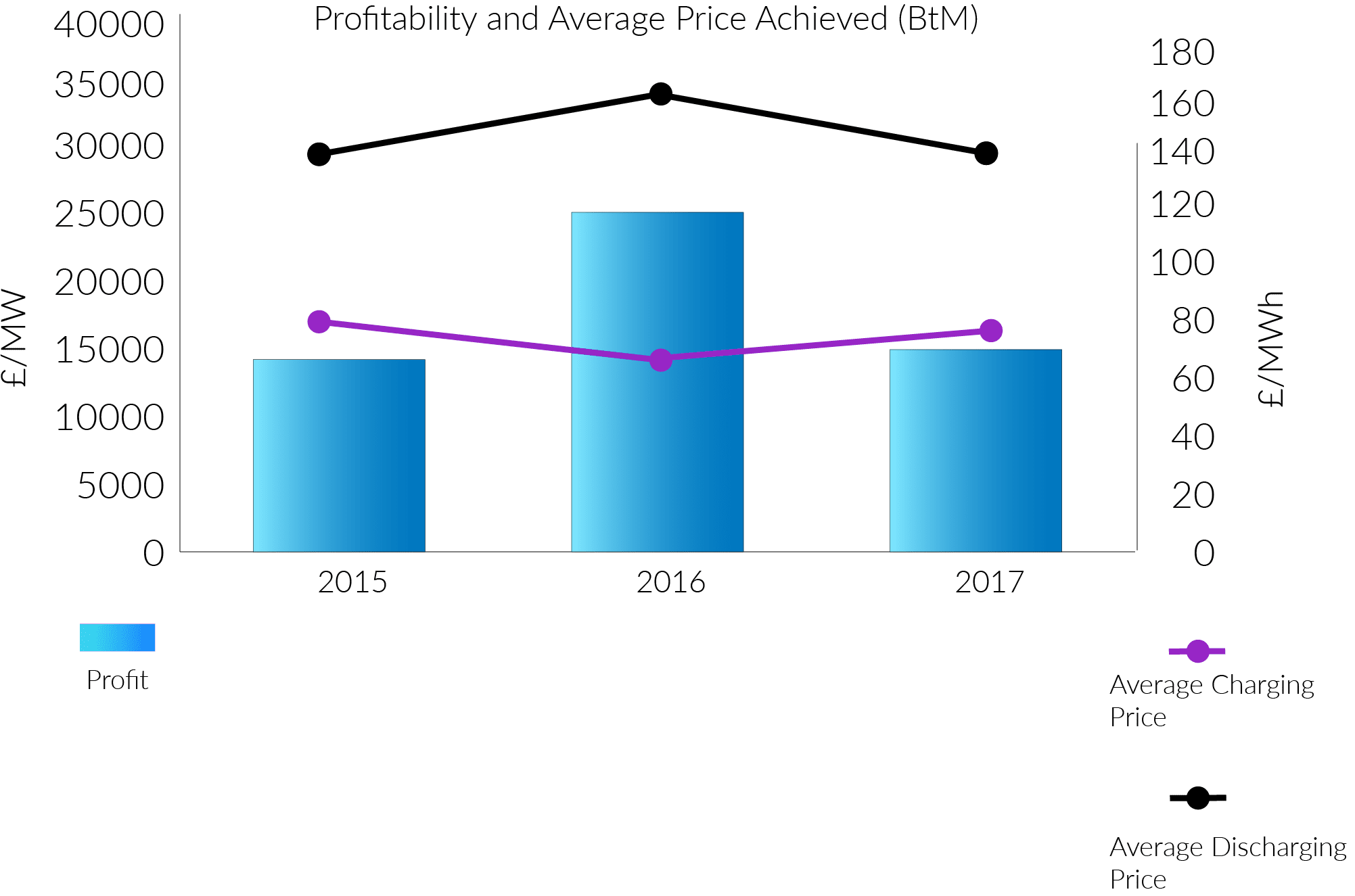

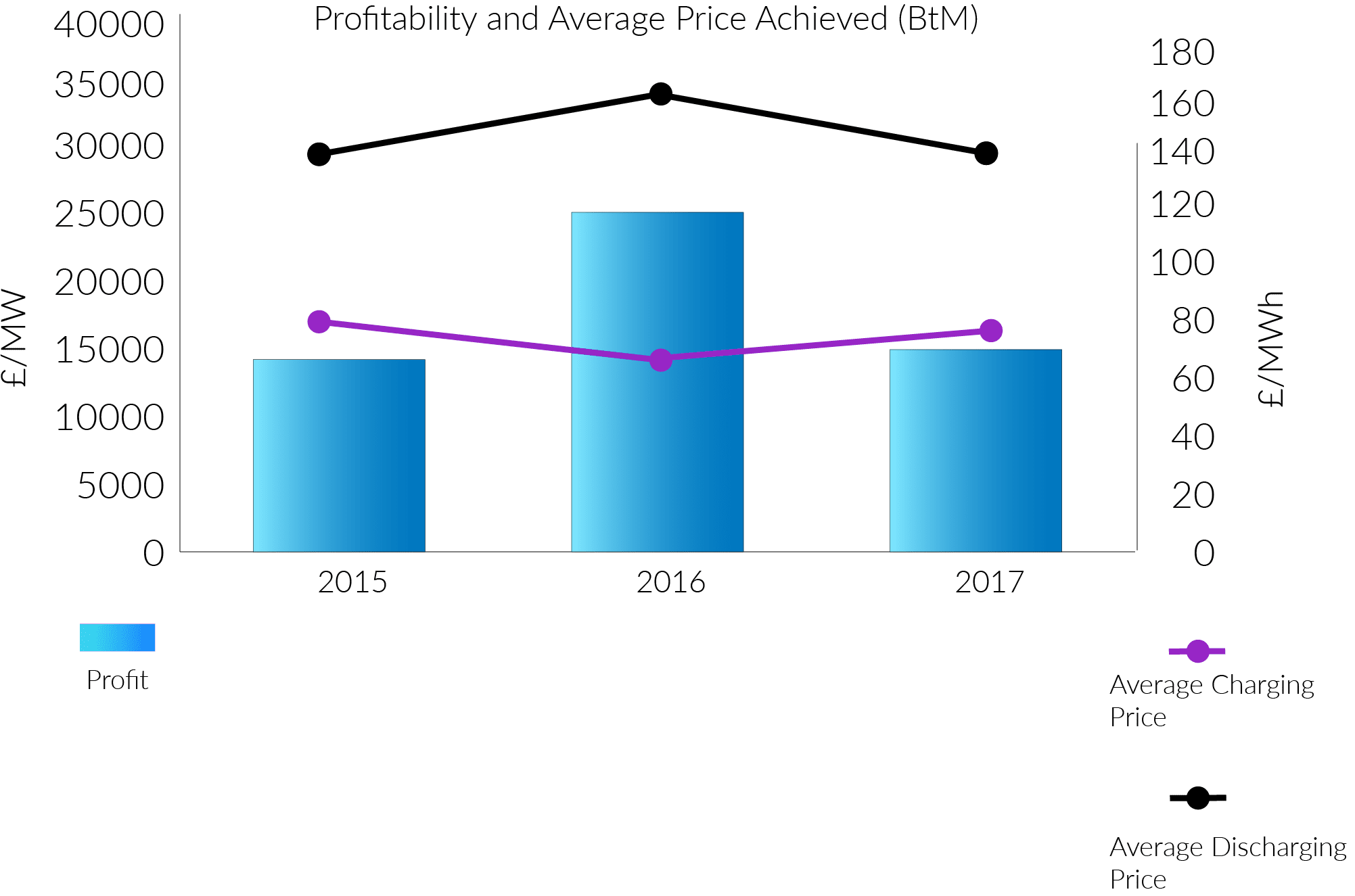

With regards to this final suggestion, adding a battery behind the meter can optimise consumption around key charging periods and provide a backup system, further improving the business case for batteries. In order to fully harness the benefits and make behind-the-meter opportunities a success, businesses must be mindful of the site conditions (note, the increased charging costs are caused by final consumption levies).

Source: SEFE Marketing & Trading Analysis

The removal of these levies is essential to the successful deployment of energy storage. Otherwise, the potential for wholesale energy storage trading, as well as the benefits of energy storage to the UK will be limited. For removal to be successful, collaboration with Ofgem, BEIS, EMRS and Elexon is required, which we are confident of during 2018.

A key theme for the industry in 2017 was “access to the balancing mechanism”. This is currently a difficult and expensive route for smaller assets with operational risks (despite the industry hype). Concerns remain over whether National Grid will fully utilise smaller assets, and whether or not a low-cost mechanism can be implemented to access this revenue. In the meantime, the option available for generation assets is to access a derivative of the balancing mechanism returns through imbalance management.

With regards to SEFE Marketing & Trading’s role in the market, we’re going to continue to support battery deployment. Our focus will remain on wholesale optimisation of storage assets where they have flexibility available. Furthermore, we will continue to work with Ofgem, BEIS, National Grid, Distribution Network Operators, Energy Associations and developers to create an environment that will allow electrical storage to deliver its potential to the best of its abilities.

We’d like to thank Ed for taking the time to discuss energy storage and battery trading with us.

To discover more about careers at SEFE Marketing & Trading, please visit our homepage.

The views, opinions and positions expressed within this article are those of our third-party content providers alone and do not represent those of GaM&T. The accuracy, completeness and validity of any statements made within this article are not guaranteed. SEFE Marketing & Trading accepts no liability for any errors, omissions or representations.